Fun Tips About How To Buy Index Shares

That is why the risk of the first national railroad strike in 30 years is so.

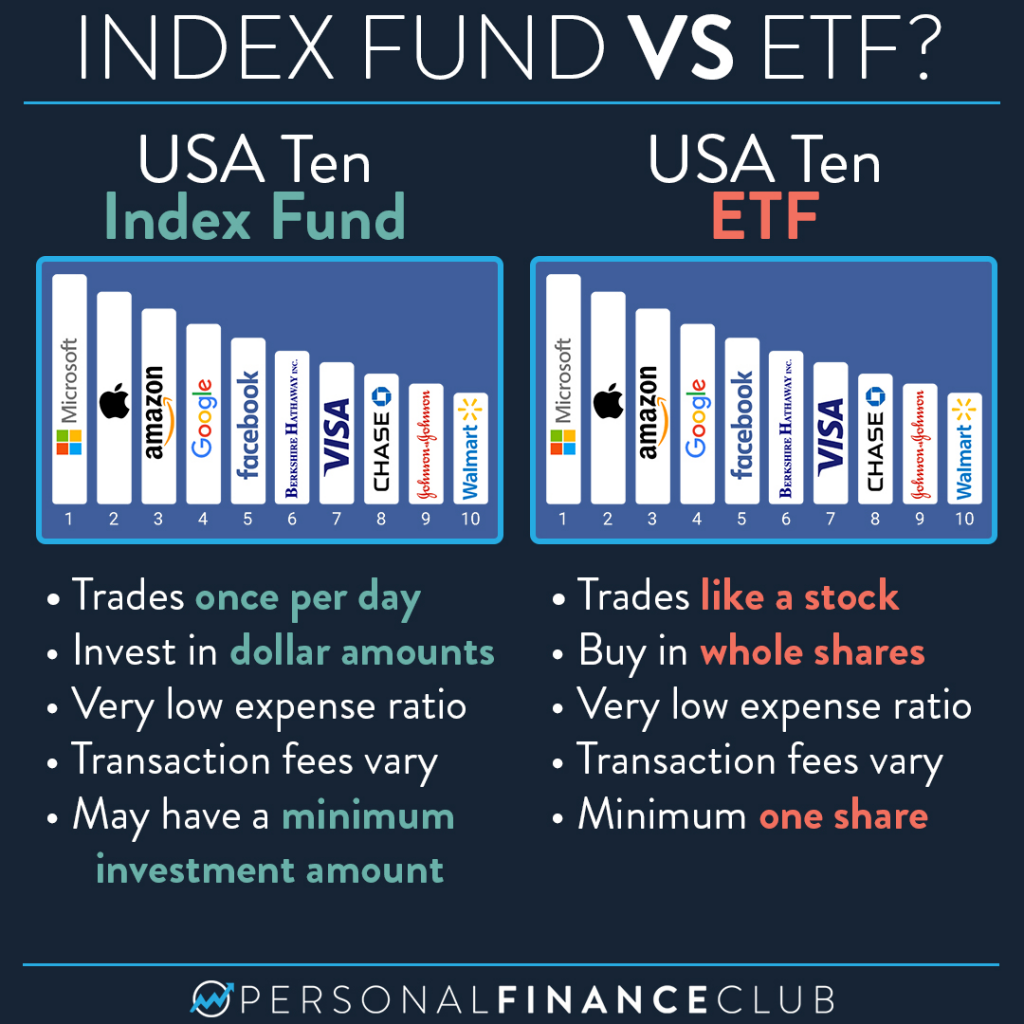

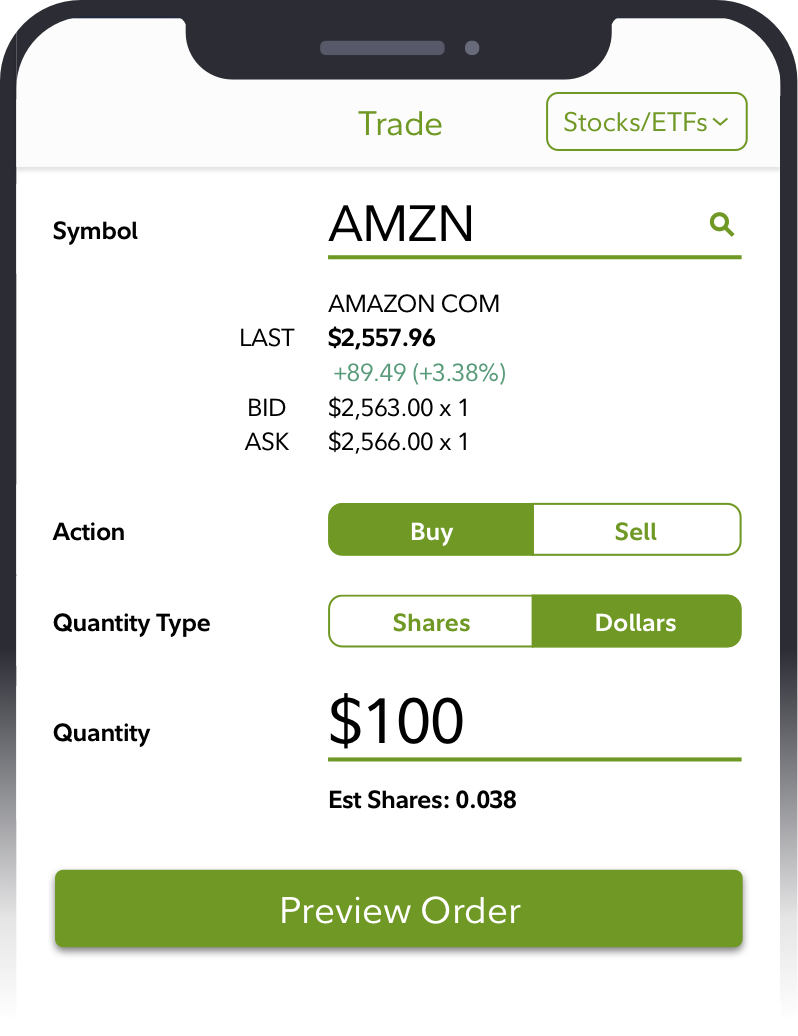

How to buy index shares. If you currently have an ira or 401(k), you can buy shares of mutual funds or etfs with your current account. Buy in bulk, or invest in fractional shares. When you buy an index fund, you get a diversified selection of.

Investing in an index can only be done indirectly, but index mutual funds and etfs are now very liquid, cheap to own, and may come with zero. Used small aircraft tugs for sale open balcony garden ideas open balcony garden ideas The bhp share price has underperformed the market over the last 30 days, falling 6% to trade at $38.05.

Vanguard may charge purchase and redemption fees to buy or. New york (cnn business) the us economy can keep running without freight trains — but not for long. Companies based on their market capitalization.

According to vanguard, the average expense ratio across its index mutual funds is 73% less than industry average. In the second step we will add capital to execute the first investment in shares. You can sign up to an.

That leaves it boasting considerable upside, according to most experts. To do so, just log into your account and search for your desired. One of the easiest and cheapest ways to access index funds is via exchange traded funds (etfs) traded on the australian securities exchange (asx).

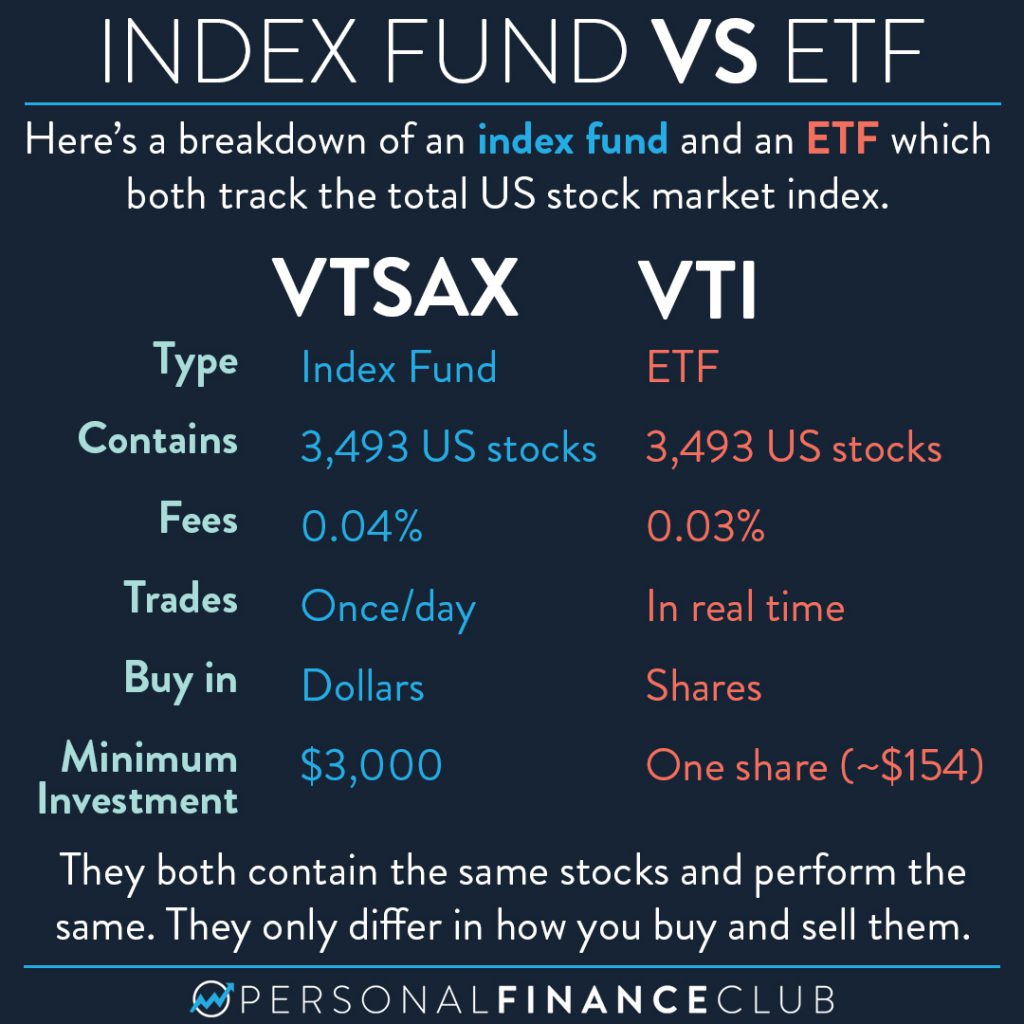

You can't actually invest in the index but you. The minimum investment is $3,000. An s&p 500 index fund, for example, contains stock shares of 500 of the largest publicly traded companies in the u.s.

Before you can buy index stocks, you'll need to open a brokerage account if you do not already have one. Your capital is at risk. Investments can go up and down in value, so you could get back less than you.

Other stock indexes cast even wider nets: Buying etfs or shares outright: The s&p 500 is an index that tracks 500 of the largest u.s.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

:max_bytes(150000):strip_icc()/Investopedia-terms-indexfund-V2-774c15b9769e4631b707ffc68c6fd366.png)